A Speculative Look at the Proposed Roadmap for Foreign and Domestic Capital

Japan, it seems, is poised at the precipice of something. The government is discussing a new economic stimulus package of considerable size, ostensibly designed to breathe life into the nation's investment landscape. The key mechanism, we are told, involves tax cuts intended to spur robust Japan Investment and draw both domestic and international Capital into pre-selected areas. These areas, 17 in number, have been rather grandly labeled Strategic Sectors, suggesting a clarity of purpose that one sincerely hopes translates into reality. This initiative, championed by Prime Minister Sanae Takaichi, represents her inaugural major economic policy. It promises a decisive, albeit speculative, shift toward targeted funding. Every country manager and potential investor in the Japanese market is advised to watch this space, preferably whilst nursing a strong espresso.

Revitalizing Growth: The New Stimulus Framework

The proposed economic package is expected, or perhaps merely hoped, to exceed last year’s figure of $92 billion. One must assume that ‘exceed’ is a euphemism for 'significantly larger,' given the scope of the ambition. This framework rests on three pillars: tackling inflation, funding growth industries, and enhancing national security. An interesting combination, to be sure.

The underlying objective, if one can truly discern it, is the wholesale revitalisation of the industrial base via focused intervention. A new economic strategy headquarters now sits at the centre, acting as a policy command centre. This structure suggests the government intends a cohesive execution, rather than the usual bureaucratic scattergun approach. One can only wish them the best of luck with that. Frankly, watching bureaucracy attempt to be nimble is often akin to watching a particularly slow-moving slug try to win a relay race.

Policy Predictability for Global Capital

Perhaps the most immediately appealing aspect for foreign investors—and I use the term 'appealing' loosely—is the promise of enhanced policy predictability. This will supposedly be achieved via multi-year budget allocations for priority projects. Capital does not, as a rule, enjoy volatility, and long-term planning horizons are the sine qua non of fixed investment.

By committing funding over several years, Japan might alleviate the typical anxieties associated with sudden fiscal shifts. For country managers burdened with justifying substantial Japan Investment to sceptical head offices, this predictable, multi-year framework is, quite frankly, a godsend. It allows them to proceed with large Capital projects—factory construction, research centres, and the like—without the persistent worry of the rug being pulled out from under their feet. It remains to be seen if political realities will align with these fiscal aspirations, but one lives in hope.

Unlocking Japan Investment: Tax Incentives

The primary lever for driving this glorious new era of Japan Investment is a proposed corporate tax scheme. This marks a potentially significant moment in Corporate Tax Policy history. The plan involves allowing firms to deduct a portion of specific Capital investments—such as machinery and factory buildings—directly from their corporate tax bill. This, naturally, is a considerable incentive; it significantly reduces the effective cost of expansionary activity. One might even call it a bribe.

The true success of this plan hinges entirely on the final deduction rates. A generous rate could genuinely position Japan as a strong contender in the global race for high-value Capital. (One should, of course, monitor the Ministry of Finance's output for the actual figures, assuming they ever emerge from the drafting stage: Tax Reform : Ministry of Finance - 財務省).

Shifting Focus: All Company Sizes

A curious and rather welcome deviation from past policies is the inclusive scope of this framework. Historically, small businesses were the government's darlings, receiving the bulk of the fiscal attention. This new approach applies the tax incentives regardless of company size. This inclusion of large MNEs and major domestic players suggests the government has, finally, acknowledged where the bulk of transformative Capital investment actually resides. This broad scope benefits large foreign entities currently contemplating Japan Market Entry or expansion. By treating all firms equally, the objective is clearly to maximize the volume and technological calibre of incoming Capital. One hopes that the civil servants responsible for drafting the fine print don't accidentally invent a new loophole only accessible by companies whose name contains a 'Q' and a number.

Focus on Strategic Sectors: 17 Key Areas

The strategy dictates that Japan Investment will be focused strictly on 17 specific Strategic Sectors. This precision is an attempt to ensure the money goes precisely where the government believes it should, rather than accidentally funding, say, another chain of themed cat cafés. The list is comprised of industries deemed critical for Japan's technological and long-term economic security. These include the usual suspects: Artificial Intelligence, semiconductors, shipbuilding, aerospace, and defense technologies. This deliberate concentration allows investors to align their strategies with the national zeitgeist. Such alignment, we speculate, often results in smoother regulatory interactions and easier access to supplementary funding. The whole exercise is designed to concentrate Capital where Japan desperately seeks to establish, or perhaps desperately re-establish, global superiority.

AI, Semiconductors, and Defense Implications

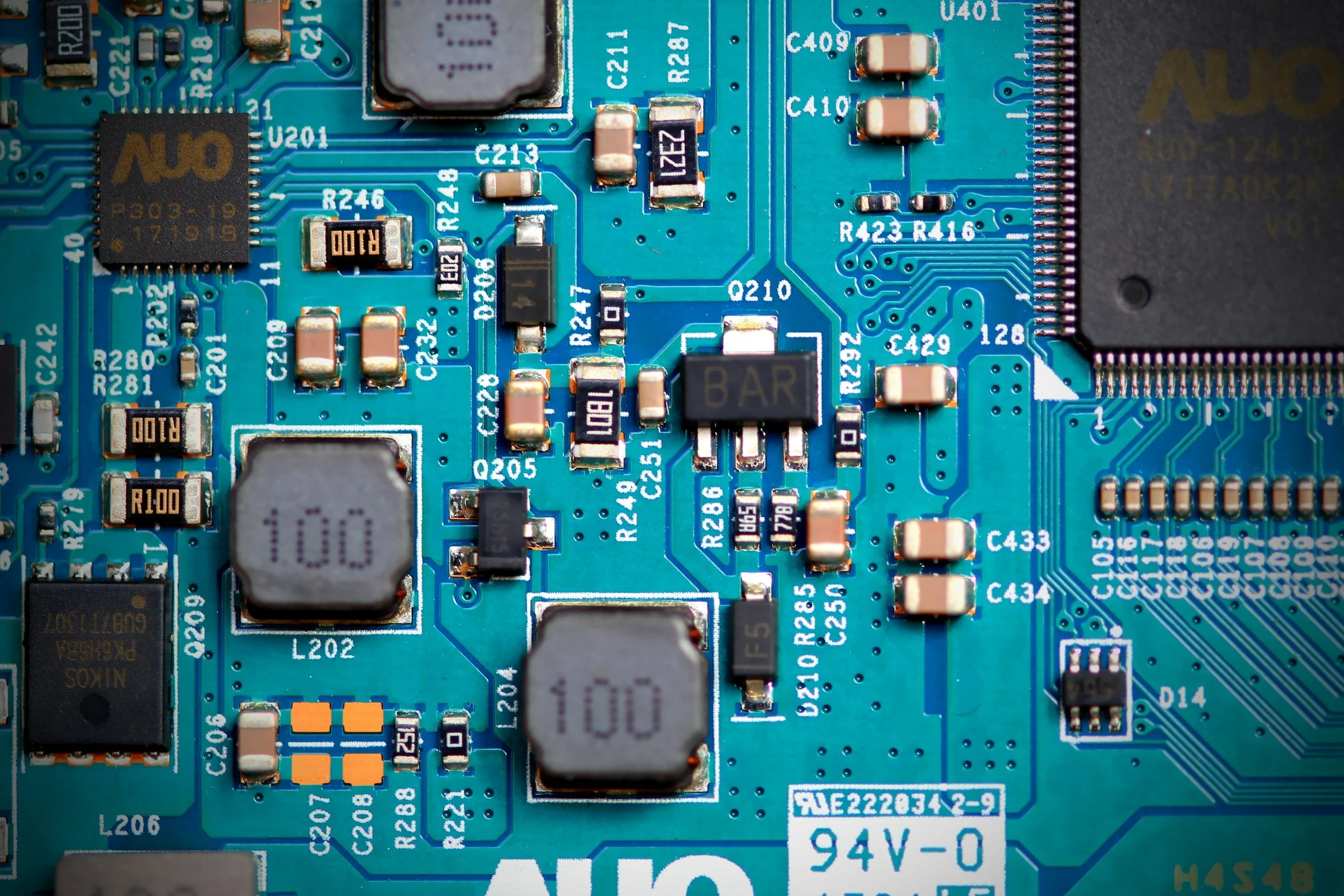

A detailed view of a semiconductor circuit board, a core example of the Strategic Sectors receiving substantial Japan Investment and Capital through the new economic stimulus.

The inclusion of AI and semiconductors merely confirms that Japan is watching the rest of the world. Global industrial policy demands state-backed focus on these areas. Japan is already making significant efforts to revive its domestic chip supply chain. (For the rather optimistic details, one might consult the World Economic Forum: How Japan's semiconductor industry is leaping into the future - The World Economic Forum). The sudden, emphatic interest in defense and aerospace suggests a distinct move toward bolstering high-tech security capabilities in a rather uncomfortable geopolitical climate.

A Selection of the Strategic Sectors Earmarked for Japan Investment:

Advanced Computing: Including AI infrastructure; hoping for a boom, preparing for a whimper.

Microchip Manufacturing: Building more fabs; the real factory floors, not the automated ones.

Green Technology: Funding renewables; because global warming, unlike bureaucracy, is real.

Shipbuilding and Maritime: Modernizing ports; ensuring Japan's ability to trade globally.

Aerospace & Defense: Enhancing domestic production; a prudent, if slightly belated, measure.

Biotechnology and Healthcare: Investing in future medicines; we need to live long enough to pay the taxes.

Digital Transformation (DX): Attempting to digitize the paper-heavy; a Sisyphean task, perhaps.

These sectors, if the incentives prove sufficient, offer meaningful openings for foreign firms with specific expertise. A combination of policy support and tax deductions makes the case for deploying substantial Capital here, provided one enjoys navigating complex regulation.

A New Era for Doing Business in Japan

For established firms Doing Business in Japan, this stimulus is arguably a welcome tool for measured expansion. The inclusion of all company sizes means previously shelved large-scale Capital projects might be financially viable again. The multi-year budgeting component should alleviate the fear of governmental fickleness, empowering country managers to proceed with complicated, long-cycle initiatives. Furthermore, whispers of regional revitalization accompanying these industrial clusters suggest that additional incentives might be available outside the traditional metropolitan hubs. This could, if managed correctly, present highly favourable conditions for establishing new operational centres away from the perpetually crowded capital.

Operational Strategy for Country Managers

Country managers should not waste time dithering. They must immediately audit all prospective Capital expenditure plans currently sitting in the 'maybe' file. If these initiatives align with the 17 Strategic Sectors, the financial modeling must be recalculated to reflect the new tax deduction potential. Engagement with government bodies and industry associations is now mandatory to decipher the inevitable fine print of the tax scheme. The push towards high-tech sectors requires a corresponding, and frankly immediate, focus on securing skilled talent in engineering and advanced manufacturing. This stimulus is less a financial gift and more a heavily subsidized mandate for rapid operational and technological modernization.

Navigating the Regulatory Landscape

Modern avionics in a cockpit, illustrating the high-tech focus within Japan's designated Strategic Sectors and the potential for Capital growth in aerospace and defense.

The sheer magnitude of public funding necessitates a transparent and navigable regulatory environment. Japan has certainly been attempting to improve its structure to attract foreign direct investment (FDI). The JETRO Invest Japan Report 2024 indicates ambitious targets for FDI stock by 2030, which, while laudable, feel rather distant. (One might peruse the report for the full dose of government optimism: JETRO Invest Japan Report 2024 | Reports - Why Invest). The government’s commitment spans fiscal measures, bureaucratic streamlining, and securing skilled labour, all of which are, naturally, works in progress. Companies contemplating a Japan Market Entry should view this stimulus as a rather large and expensive signpost pointing towards the government’s long-term interests.

Long-Term Market Entry Planning

For foreign companies planning their Japan Market Entry, this stimulus presents both a clear path and a certain degree of competitive pressure. Entry strategies should unequivocally target the specified Strategic Sectors to maximize the incentives. A precise understanding of how the new tax scheme applies to foreign subsidiaries and branches is paramount.

Companies should secure specialized legal and tax advice now to ensure they structure their entities optimally for claiming the largest possible deductions for Capital investment. The multi-year budgeting offers the necessary reassurance to secure the all-important global board approval for establishing a serious presence here. Frankly, leveraging this proactive, if slightly desperate, policy environment is probably the least painful route to establishing a competitive footing.

Strengthening National Economic Security

A quiet, yet crucial, objective of this three-pillar strategy is to bolster national economic security. By incentivizing the domestic manufacturing of key components, Japan aims to reduce its reliance on occasionally unreliable international supply chains. This push for domestic resilience offers investors a distinct benefit: long-term stability in their operational environment.

Firms that align their private-sector Capital deployment with these national security goals are likely to find themselves in a preferential position for governmental engagement and partnership. This strategic confluence of private interest and public necessity is designed to create a resilient environment for sustained Japan Investment, hopefully insulating crucial industries from external economic shocks.

The Role of Domestic and Foreign Capital

The ultimate success of this entire speculative venture hangs upon the collaborative response of both domestic and foreign Capital. Japanese firms are expected to utilize the tax breaks to upgrade their (often ancient) facilities, while MNEs are hoped to bring in cutting-edge technology and global management practices.

The government clearly seeks this symbiotic exchange, believing the infusion of diverse technologies will accelerate innovation beyond what could be achieved through domestic efforts alone. This policy, ultimately, aims to create a surprisingly level playing field for large Capital expenditure. The most aggressive, growth-focused businesses—wherever they hail from—will be the primary beneficiaries. This, perhaps, is the time for foreign investors to deploy their Capital decisively, seizing a first-mover advantage while the policy window remains invitingly open. One rarely gets a second chance to be this optimistic.